Consistently consistent, effortlessly effective and meaningfully measurable, direct mail marketing has been a proven ROI-yielding advertising medium for centuries. In fact, the Babylonians would circulate stone tablets advertising goods available for purchase when visiting neighboring towns.

Just as stone tablets became papyrus and papyrus became 60# paper, much has changed in direct mail marketing in an effort to make the medium more effective. From leveraging our knowledge of paper vs. digital mail, to testing the effects of personalization, direct mail has proven to be an adaptable medium that still packs a mighty marketing punch. How does ROI that’s 7 times greater than other marketing avenues sound to you?

Because the cost of direct mail has been trending downward, thanks (ironically) to the increased efficiencies of digital manufacturing technology, direct mail has become more accessible to smaller companies hungry for a competitive advantage. Case in point, we recently stumbled across a great use case of modern direct mail marketing by a small community bank that far surpassed expectations. (All due credit to The Financial Brand who originally highlighted this campaign.)

The Background

Community bank marketers, in the classic David v. Goliath scenario, face steep competition against the larger, more established players in the retail banking space. Especially when targeting the likes of Millennials, the perception is that these larger institutions possess more advanced technology and have a much larger branch footprint. However, the research shows that people still generally prefer smaller banks handling their most intimate financial affairs. If this is the case, how can a small, agile bank go on the offensive and use that advantage to win clients?

The DM

The community bank in question, Liberty Bank, took aim at new homeowners in the area (a two-mile radius around five central branches) and created messaging that established the bank's presence, while positioning it favorably against both direct (other small retail presences) and indirect (large institutional) competitors. The objective was simple—capitalize on people's longstanding preference for small banks and diffuse any misconceptions associated with these community institutions, i.e., archaic technology, less branches, less savvy financial products, etc.

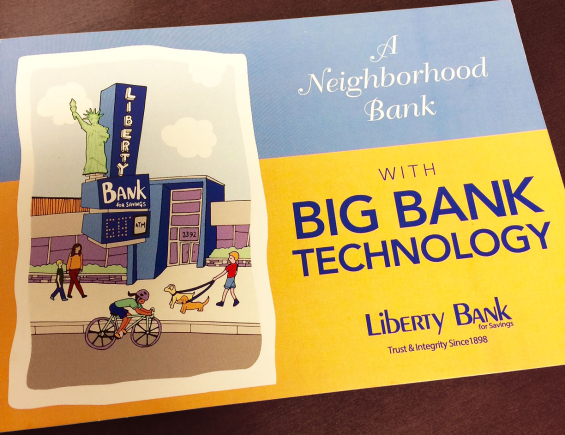

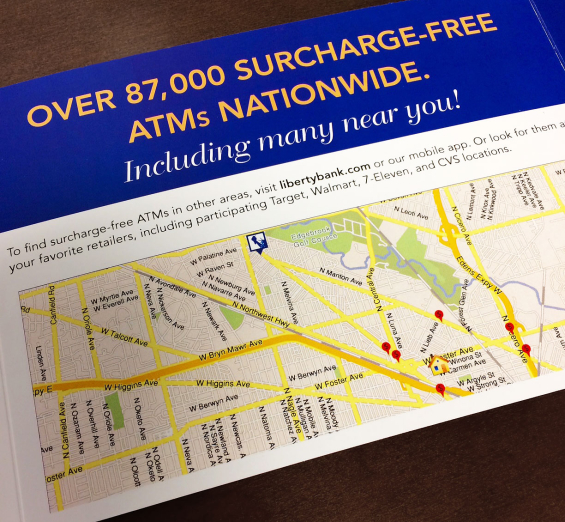

The monthly DM piece was constructed as a 5 x 7 folded mailer (seen above) and positioned Liberty as a "neighborhood bank," with "BIG BANK TECHNOLOGY." Everything, from the retro illustration to the alternating typeface for the copy (from cursive to bold sans serif), communicated the point that this community bank was indeed, the best of both worlds—a grounded 100-year establishment that could go toe-to-toe with the larger players. On the inside of the mailer, Liberty went straight for the jugular, touting "over 87,000 surcharge-free ATMs nationwide," with a casual mention that this is twice as many as Chase and Bank of America combined.

Perhaps most important was the bank's use of variable data printing in order to reinforce its message and make the communication relevant to each individual recipient. By incorporating a map of each recipient's closest ATM locations, Liberty delivered on its core value proposition in a meaningful way.

The ROI

Four months and thousands of mailers later, Liberty established dozens of new accounts at an average cost of $383 per account. Assuming a conservative estimate and a five-year relationship, total revenue generated from the new accounts opened will amount to about $90,000, ninefold the campaign's cost. Also, important to note, these estimates are based solely on initial deposits and did not take into account additional product/service relationships nor capital appreciation.

The Takeaway

With competitive positioning strategies and the ability to personalize messaging for every single potential customer, the strength of DM is maximized, and consumers are likelier to act. Safe to say, direct mail has come a long way since the stone age. And while some agencies still use the same methods our ancient brethren utilized (spraying and praying the same message to the same audience repeatedly), here at Wilen New York, we pride ourselves on leading the way in data-driven, highly relevant, 4-color variable direct mail. From the community bank looking to gain a competitive edge to the Fortune 500 looking to communicate with their new and existing customers relevantly at scale, we have the right tools and know how to use them.